san francisco gross receipts tax instructions 2020

1001 Supplemental Guidelines to California Adjustments the instructions for California Schedule CA 540 California Adjustments - Residents or Schedule CA 540NR California Adjustments - Nonresidents or Part-Year Residents and the Business Entity tax booklets. There are seven federal tax brackets for the 2022 tax year.

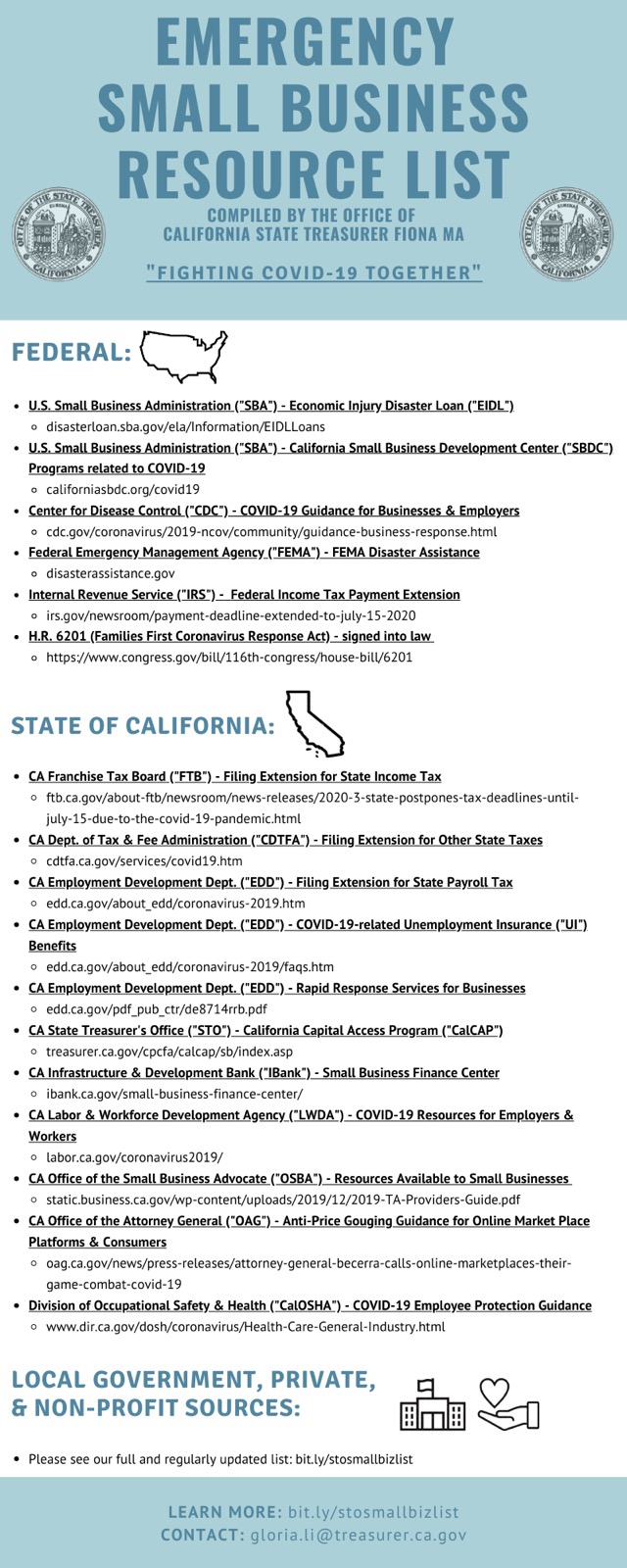

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

You will be directed to another page.

. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style. Gross incomes between 1 million and 4999999 million pay a tax of 6000.

Here there is a form to fill. Ha Is this a group return for. Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off.

A For the 2020 calendar year or tax year beginning 2020 and ending 20 B Check if applicable. 2020 Instructions for Form FTB 3805V Net Operating Loss. Los Angeles and San Bernardino County Severe Winds 1111.

Therefore you will not be responsible for paying it. Gross incomes between 500000 and 999999 pay a tax of 2500. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

One is continuing to spur innovation and investment in RD. This can sometimes take several weeksthe sooner you start the process the sooner youll have the tax account info required to pay them. In a graph posted at Microsofts Activision Blizzard acquisition site the company depicts the entire gaming market as worth 165 billion in 2020 with consoles making up 33 billion 20 percent.

Reporting on information technology technology and business news. Federal government websites often end in gov or mil. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Before sharing sensitive information make sure youre on a federal government site. Microsoft describes the CMAs concerns as misplaced and says that. Including Detroit and San Francisco are home to growing publicly and privately owned surveillance camera networks that law enforcement can.

Los Angeles and San Bernardino County Severe Winds 1111. Mariposa and San Francisco Counties Rim Fire 0813 to 1013 2011. Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses.

10 12 22 24 32 35 and 37. News for Hardware software networking and Internet media. In 2020 the Supreme Court.

These are the rates for taxes due. 2020 Instructions for Form FTB 3805Q Net Operating Loss. Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised.

Filling the forms involves giving instructions to your assignment. The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the. This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK.

An extensive glossary on any terms weve discussed to help you understand all things crypto. California registration and tax info Before you can pay employees make sure youve registered for payroll in their applicable work state. Gross incomes of 5 million or greater pay a tax of.

The instructions provided with. I think that tax policy and tax credits can play a very important role in two respects. 2 An importer will be considered to have a significant financial hardship if the operation of such importer is fully or partially suspended during March or April 2020 due to orders from a competent governmental authority limiting commerce travel or group meetings because of COVID-19 and as a result of such suspension the gross receipts of.

Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries. Regulators are leaning toward torpedoing the Activision Blizzard deal. An ESB NOL is an NOL incurred in a trade or business activity that has gross receipts less returns and allowances of less than 1 million during.

Initial return Final returnterminated Amended return G Gross receipts Application pending F Name and address of principal officer. The gov means its official. 11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for.

Your bracket depends on your taxable income and filing status. Other cities in the US. You also give your assignment instructions.

John Carter is a 2012 American science fiction action film directed by Andrew Stanton written by Stanton Mark Andrews and Michael Chabon and based on A Princess of Mars 1912 the first book in the Barsoom series of novels by Edgar Rice BurroughsThe film was produced by Jim Morris Colin Wilson and Lindsey CollinsIt stars Taylor Kitsch in the title role Lynn Collins. The form must be filed on or before the 15th day of the fifth month after the. Additional information can be found in FTB Pub.

The information needed include. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Californias base sales tax is 725 highest in the.

Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc. An ESB NOL is an NOL incurred in a trade or business activity that has gross receipts less returns and allowances of less than 1 million during. Mariposa and San Francisco Counties Rim Fire 0813 to 1013 2011.

Short form Return of Organization Exempt from Income Tax Form 990-EZ Instructions Tax-exempt organizations with gross receipts less than 200000 and total assets at the end of the tax year less than 500000 can opt to file this form rather than Form 990.

Favorable California Pass Through Entity Tax Changes

State Gross Receipts Tax Rates 2021 Tax Foundation

San Francisco S Sourcing Rules For Computing The Gross Receipts Tax

California San Francisco Business Tax Overhaul Measure Kpmg United States

What Is Gross Receipts Tax Overview States With Grt More

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

2022 San Francisco Tax Deadlines

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Policy And Planning Documents Archives San Francisco Office Of Early Care And Education

San Francisco Gross Receipts Tax Clarification

2019 Form 990 For San Francisco Opera Cause Iq

Doing Your Taxes 10 Things You Must Know The Muse

Downtown San Francisco Is Worse Off Than You Think Findings Sfexaminer Com

3 11 3 Individual Income Tax Returns Internal Revenue Service

California Tax Forms H R Block

Homelessness Gross Receipts Tax

Your 8 Most Vexing Tax Questions Answered The New York Times

California San Francisco Business Tax Overhaul Measure Kpmg United States

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us